FAQs

To open an account with Rapidlink Microfinance Ltd, you need to visit our nearest branch with a valid ID, proof of address, and a passport-sized photograph. Our customer service representatives will guide you through the process. You can also start the application online. Our online application form is available on our website.

For a savings account, the minimum balance is GHC 10. For a premier account, the minimum balance is GHC 30.

We offer a variety of loan products including personal loans, business loans, and controller loans, police loans. Our personal loans are designed to meet your individual needs, while our business loans can help you grow your enterprise. Controller loans are available to support government/public sector workers. Police loans are specifically designed for our Police Force

To apply for a loan (Personal/Business), you can visit our nearest branch and apply. For a controller loan, you can apply through our website.

The Advantage Investment is similar to our Fixed Deposit but with more flexibility. The interest rate is the Bank of Ghana's rate plus 1%, and the key difference is that you have the option to add more principal to your investment at any time and as frequently as you want.

The primary difference is the ability to top up your investment. With our Fixed Deposit, you cannot add more money after the initial investment. With the Advantage Investment, you can add more principal at any time to grow your investment.

Yes, your investment is secure. We are a licensed and regulated microfinance institution, and we manage all investments with the highest level of diligence and care.

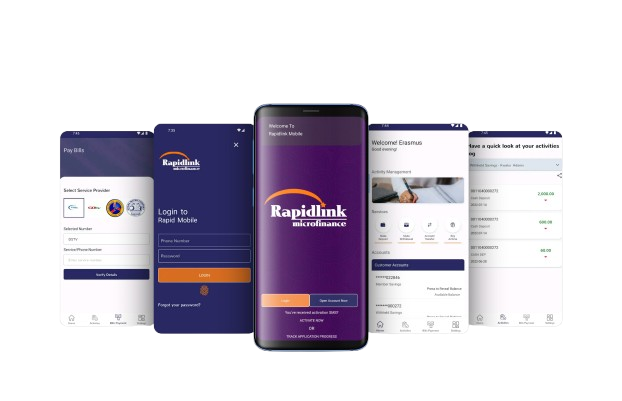

Download Our App

Get the best banking experience at your fingertips. Secure, fast, and always with you.

Available on both iOS and Android. Experience seamless banking anytime, anywhere.

© Rapidlink Microfinance Ltd. All Rights Reserved