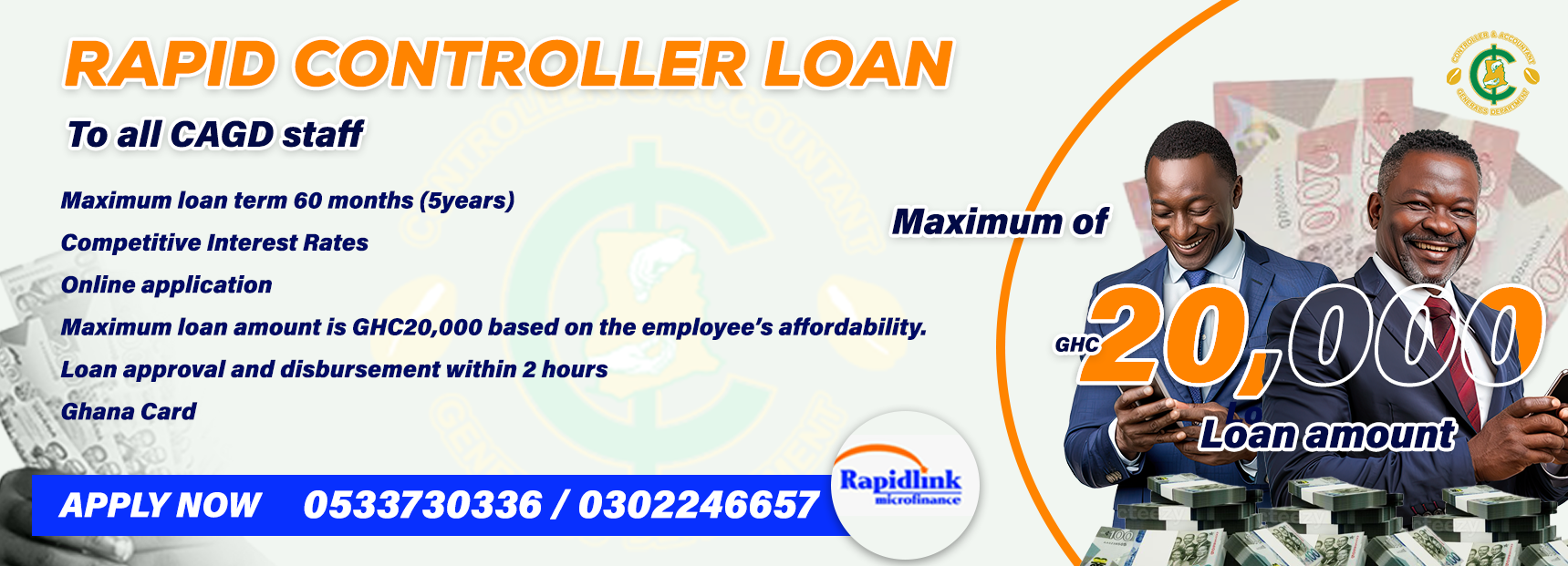

For controller/sme loans, please call

0533730336/0302246657.

For client complaints or inquiries, please call

0303955183.

RAPID SME LOAN PROMO – Maximum loan amount GHC20,000.

Maximum duration is 6 months with flexible repayment options.

Terms and Conditions apply.

RAPID CONTROLLER LOAN – To all CAGD staff.

Maximum loan term is 60 months (5 years).

Competitive interest rates.

Online application available.

Terms and Conditions apply.

RAPID POLICE LOAN – To all employees of Ghana Police Service.

Maximum loan term is 30 months.

Maximum loan is GHC20,000

Terms and Conditions apply.

What We Provide

Services We Provide

At RapidLink Microfinance Limited, we provide a wide range of customer-focused financial services tailored to individuals, micro-entrepreneurs, and small businesses:

Savings and Deposit

Micro & SME loans

Susu & Group Saving Schemes

Salary Advance & Employee Loans

Agency Banking

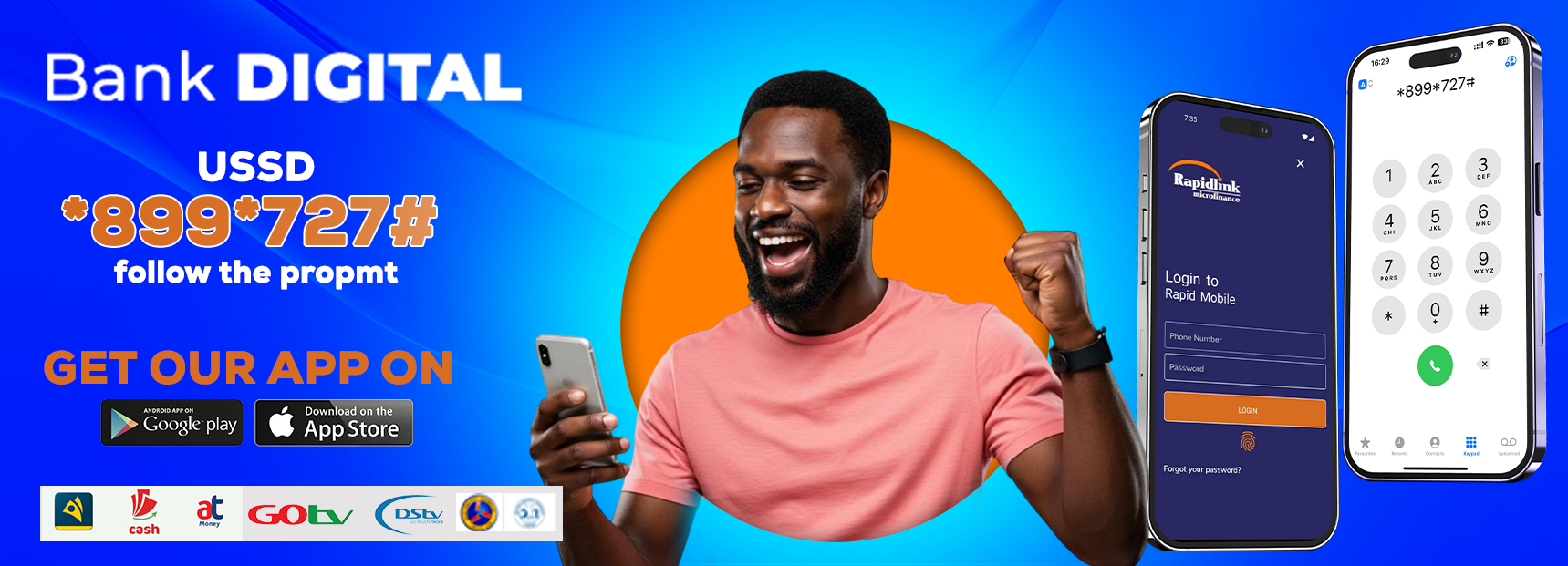

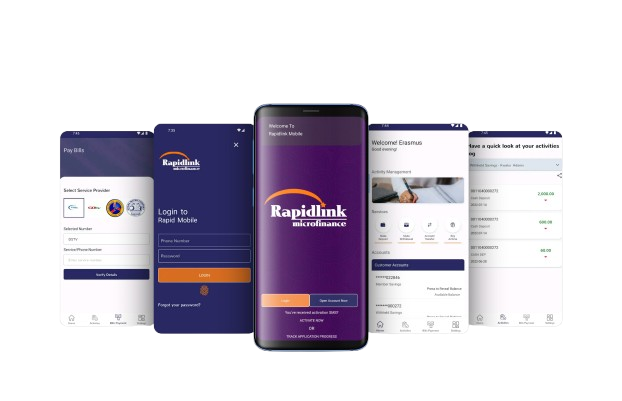

Digital Banking

Download Our App

Get the best banking experience at your fingertips. Secure, fast, and always with you.

Available on both iOS and Android. Experience seamless banking anytime, anywhere.

© Rapidlink Microfinance Ltd. All Rights Reserved